Services sector edges down in May, but holds steam

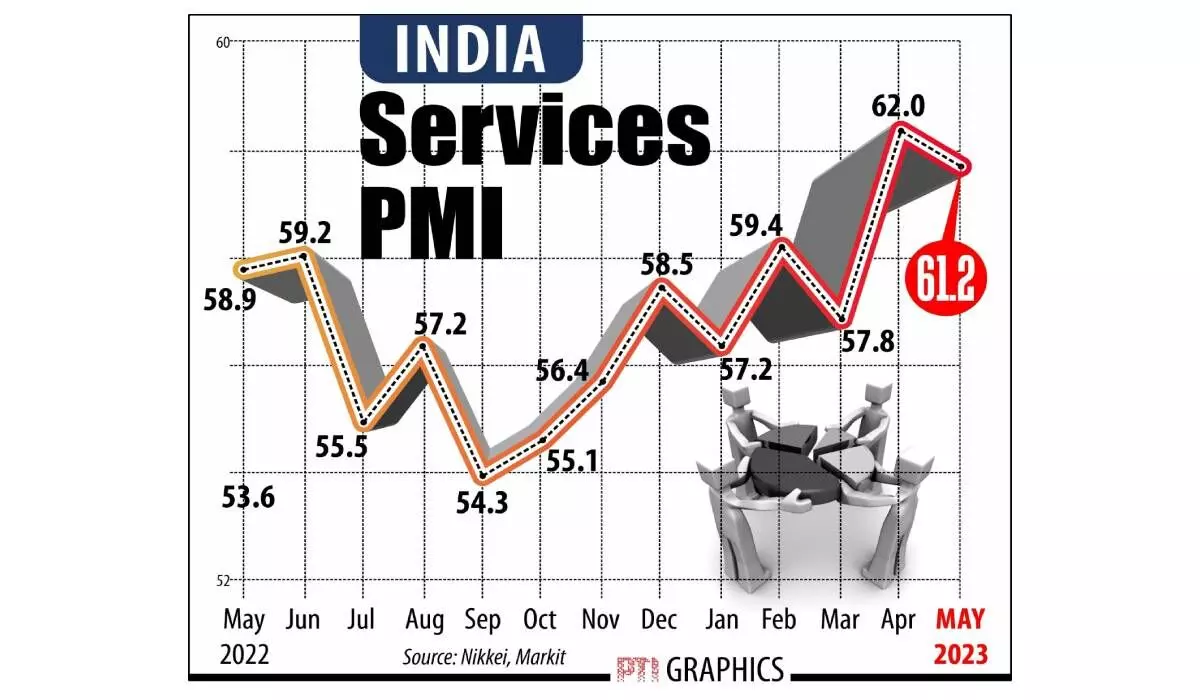

S&P Global India Services PMI Business Activity Index fell from 62 in Apr to 61.2 in May; India’s services sector output increases at 2nd fastest pace in close to 13 yrs in May

image for illustrative purpose

New Delhi India’s services sector growth eased slightly in May, but registered the second-strongest rate of growth in close to 13 years, on favourable demand conditions and new client wins, a monthly survey said on Monday.

The seasonally adjusted S&P Global India Services PMI Business Activity Index fell from 62 in April to 61.2 in May. Despite falling from April, the latest reading indicated that output increased at the second-quickest pace since July 2010. For the 22nd straight month, the headline figure was above the neutral 50 threshold. In Purchasing Managers’ Index (PMI) parlance, a print above 50 means expansion, while a score below 50 denotes contraction.

“The PMI data for May stand as a compelling testament to prevailing demand resilience, impressive output growth and job creation within India's dynamic service sector,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence.

Additionally, monitored companies expanded their workforces to accommodate for higher intakes of new work. Going ahead, services companies maintained an upbeat view that business activity would increase over the coming 12 months.

“Advertising, demand strength and favourable market conditions were among the reasons cited for optimistic forecasts,” the survey said.

Meanwhile, the S&P Global India Composite PMI Output Index -- which measures combined services and manufacturing output -- stood at 61.6 in May, unchanged from April.

“India’s private sector built on the strong momentum recorded in April by posting a rate of expansion in business activity that was the joint-best in just under 13 years,” the survey said.

Demand Resilience

- Monitored firms expanded their workforces execute new orders

- Services cos maintained an upbeat view

- Business activity expected to rise in next 12 mths